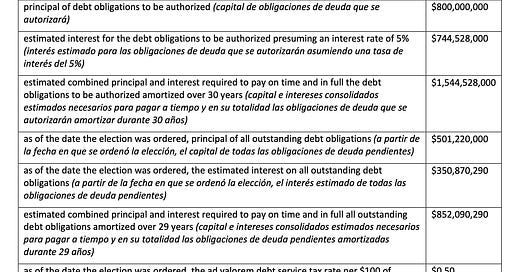

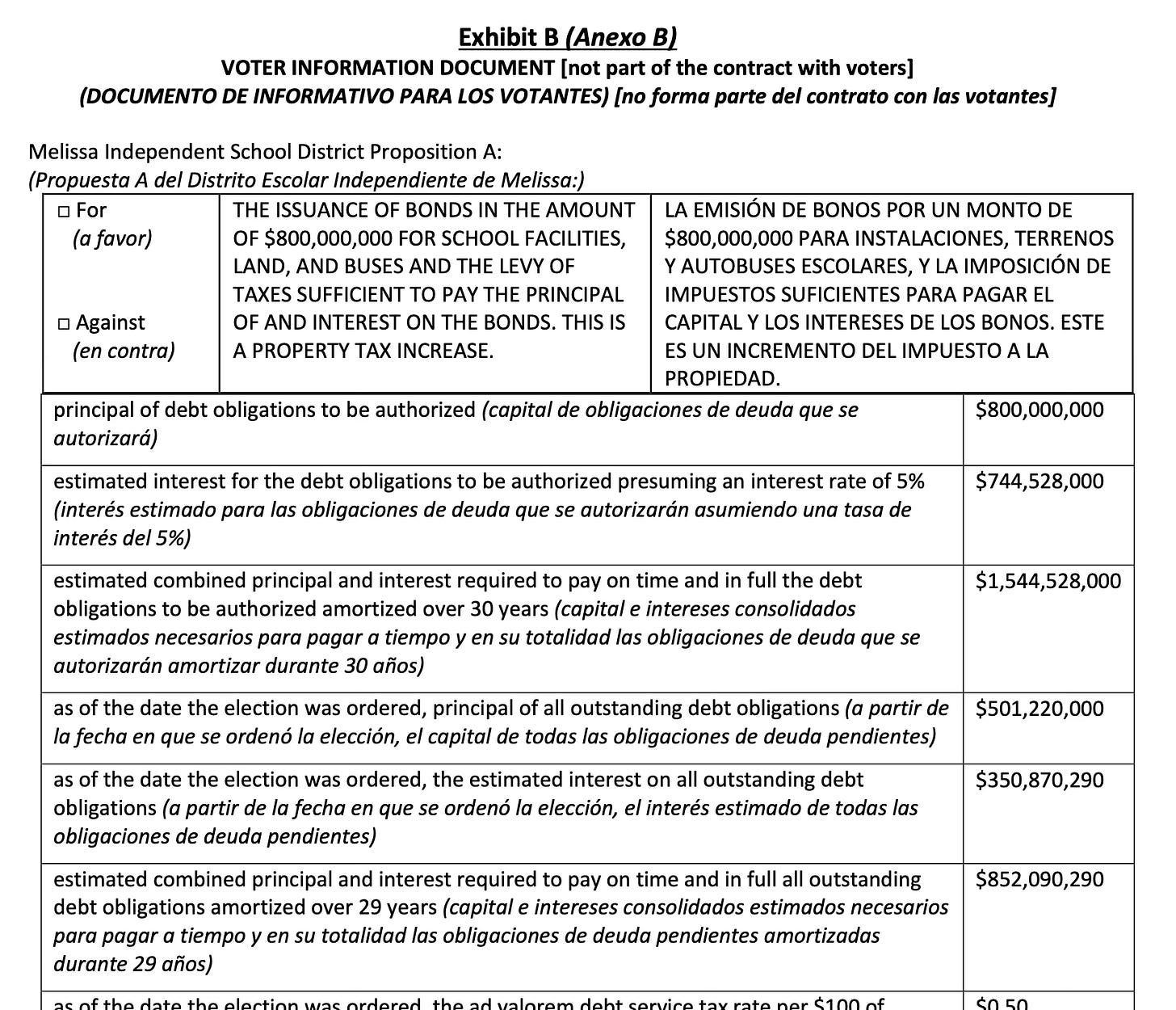

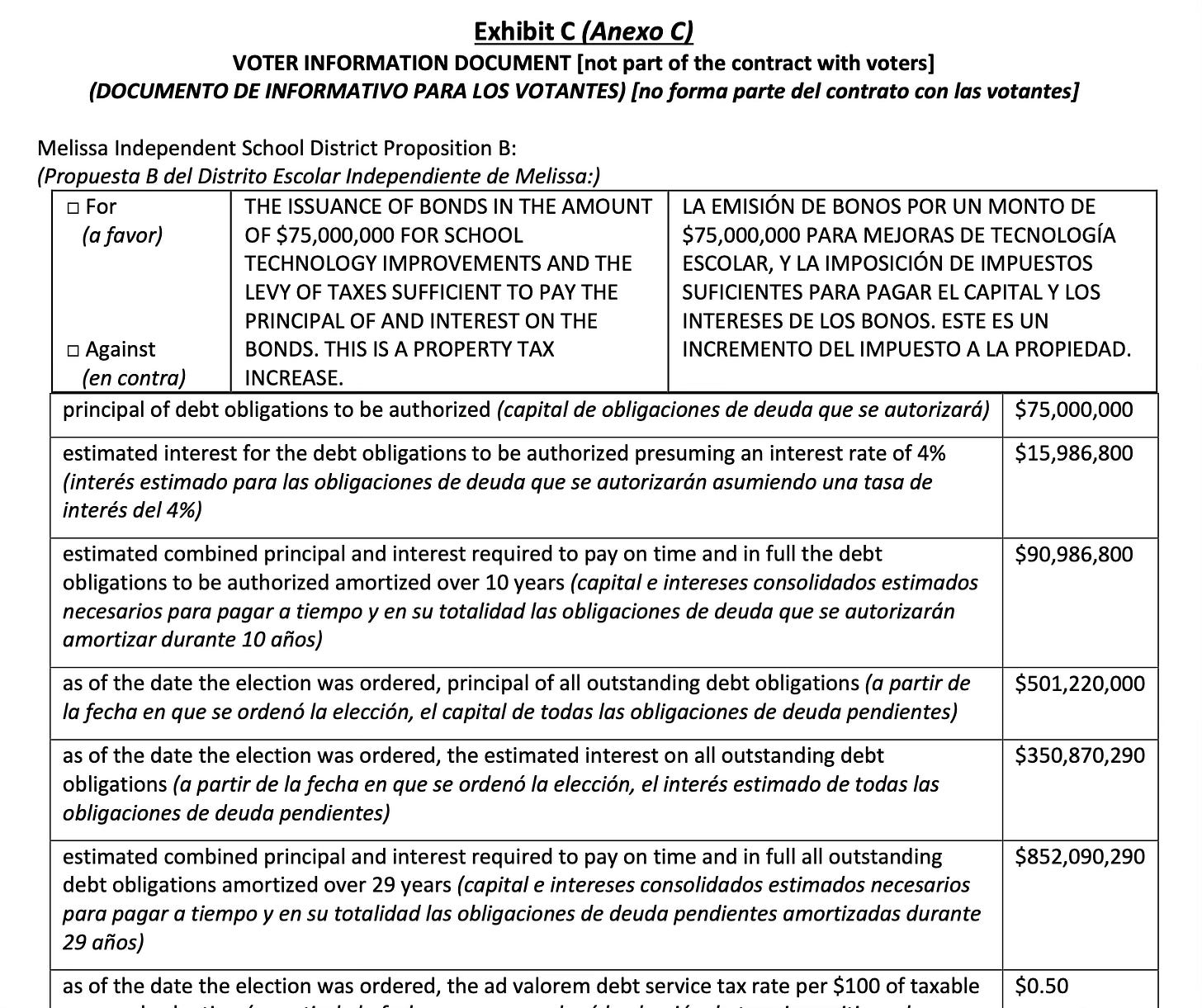

If Melissa ISD’s bond propositions pass, new documents suggest the financial impact will be greater than previously thought. Based the district’s Notice of Bond Election, an earlier $1.2 billion cost projection requires upward revision to $1.6 billion.

Proposition A:

Proposition B:

Though the document also shows current liabilities at $852 million (opposed to Texas Bond Review Board’s $632 million figure), this figure plus the revised $1.6 billion still represent the new debt’s functional tripling of the total financial obligation for which taxpayers will be responsible.

District officials know these numbers and it’s important that voters and other residents do as well. Prior articles have discussed the “THIS IS A PROPERTY TAX INCREASE” ballot language which Melissa ISD routinely works to deflect.

The same taxpayer advocates who long worked to pass this ballot language also have supported measures like ballot inclusion of current debt levels (principal and interest) as well as projected interest on new debt.

Unfortunately, it’s an uphill battle as the government protectorate of Texas Association of School Boards (TASB), Texas Association of School Administrators (TASA), Texas Municipal League (TML) and Texas Association of Counties (TAC), organizations that are all funded by local entities using taxpayer dollars, always stand ready to fight on behalf of their members and against taxpayer interests like increased transparency.

With numbers as are being revealed, it’s evident why public education wants them kept outside of public view. As discussed before, if the public knew the real numbers in advance, the challenge to pass bonds would only increase.

Another point having surfaced in response to prior articles is the district’s “no tax rate increase” stance.

The “50-Cent Debt Test” limits a school district’s maximum Interest & Sinking Fund (I&S) tax rate to 50.0 cents.

Per the Texas Comptroller’s Office, school districts face a limit on the amount of debt they can incur. It further explains how this state law commonly called “the 50-cent test” has “required districts to show they can repay their bonds with a tax rate of no more than 50 cents per $100 of assessed property value at the time of issuance.”

Melissa ISD says it “plans” to keep its I&S tax rate at the current level. By law, it can’t be raised. It will take the Texas legislature to alter or abolish this 1991 law.

Repealing such limits is another type issue for which organizations like the government protectorate lobbies, issues that benefit local entities with a path to increased taxpayer dollars. And future easing of this requirement seems likely to be just the thing to spark a change of the district’s plans.

Early voting is underway despite many residents likely being unaware while others just don’t care or else think such elections don’t matter. Maybe school district bond elections don’t figure in a district resident’s life. Make no mistake, bond election debt will.

H/T to Amy Teal and Erin Anderson for additional information.

Before relocating back to the D/FW Metroplex, Lou Ann Anderson worked in central Texas talk radio as both a host and producer. She currently hosts Political Pursuits: The Podcast. Her tenure as Watchdog Wire–Texas editor involved covering state news and coordinating the site’s citizen journalist network. As a past Policy Analyst with Americans for Prosperity–Texas, Lou Ann wrote and spoke on a variety of public policy issues including the issue of probate abuse.