Stated correctly, Melissa ISD is indeed growing, or Melissa schools are growing. And in response, district officials are seeking voter approval of two bond packages - one for $800 million, another for $75 million - which with interest (generally calculated at 40-50%) will total more than $1.2 billion.

Bond proposition specifics

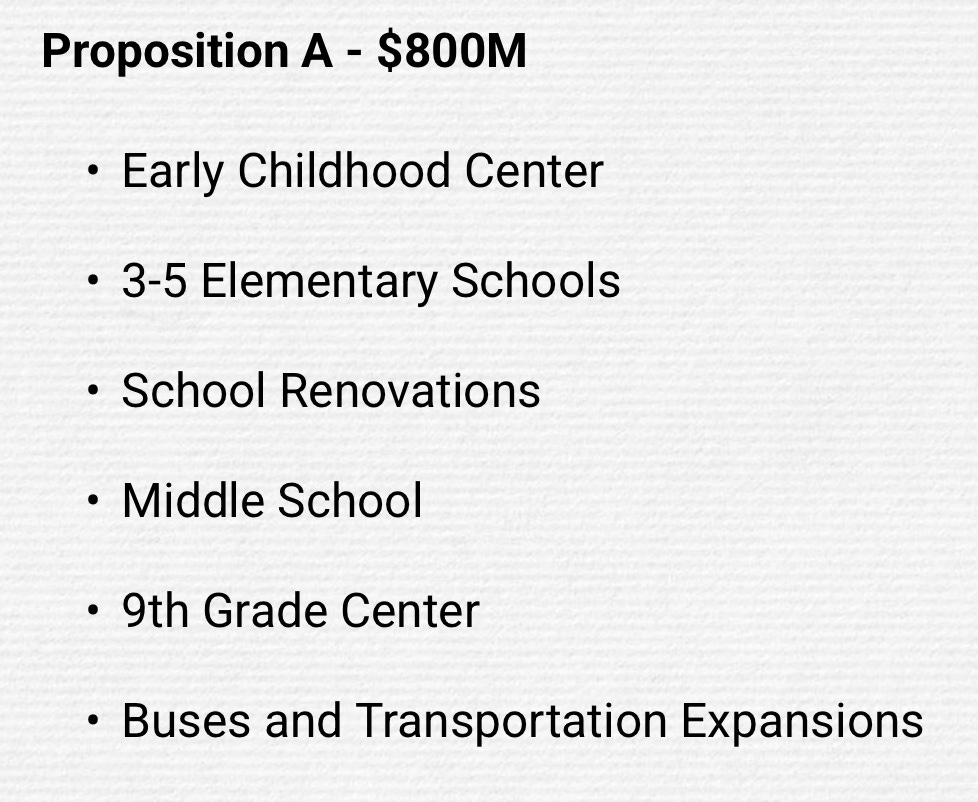

Per the MelissaISDBond.com, Proposition A for $800 million includes the following:

The $75 million sought for Proposition B entails:

The district additionally offers this growth history with corresponding projections:

“Vote for!” signs created by a Cardinals for Classrooms PAC signal a campaign supporting the May 3 bond election is underway. As a longtime observer of bond elections, campaign mechanics are predictable, instructive and worthy of future discussion.

For now, however, educating voters on local government debt levels offers an important financial overview of current obligations. After all, prudent consumers review their debt levels when considering a new, especially larger purchase. They also generally review the amount that applicable interest rates will add to the principal. Why should voters be any different with approving new taxpayer-funded debt?

Passage of Melissa ISD’s proposed $1.2 billion bond will raise property owners’ school debt obligation to $1.8 billion, functionally tripling the district’s current debt. And it will raise total local government debt to $3.7 billion.

ISD debt to overall local government debt

Melissa ISD voters typically pay taxes to the Melissa ISD as well as to the city of Melissa, Collin County and the Collin County Community College District. While current government debt levels (their own or other entities) are not something local bond proponents generally care to discuss, voters should be aware of their existing debt obligations.

With that, these figures are based on the most current information available from the Texas Bond Review Board website.

Melissa ISD:

City of Melissa:

Collin County:

Collin County Community College District:

With Melissa ISD debt currently at $632 million, the city of Melissa at $193 million, Collin County at $1.12 billion and Collin County CCD at $620 million, the average Melissa ISD resident faces $2.5 billion of local government debt. Passage of Melissa ISD’s proposed $1.2 billion bond will raise property owners’ school debt obligation to $1.8 billion, functionally tripling the district’s current debt. And it will raise total local government debt to $3.7 billion.

This is a significant increase that will probably pass. Voters, however, need to be aware of what they are approving and that this won’t be the last time they are asked for more funding.

The ISD and its bond supporters will posit how the increase will be absorbed by growth and that very well may be the case. That said, these times are subject to economic uncertainty and conditions can change such that in the interest of fiscal transparency, taxpayers need to understand their current debt picture and potential future liability.

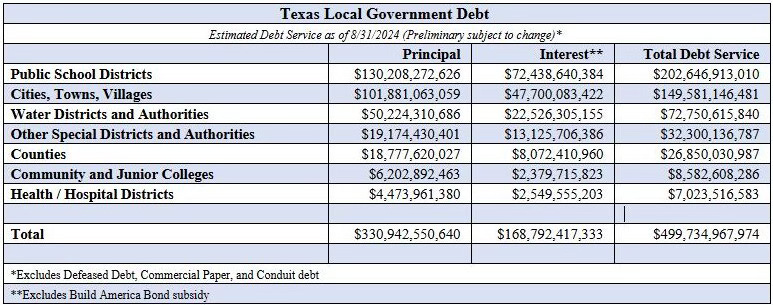

Yet again, the most heavily indebted governmental type was public school districts. In FY 2024, ISD debt reached $202.6 billion, which represents about 41% of everything borrowed.

A state and nation of debtors

The Texas Public Policy’s James Quintero reported earlier this year how “new data from the Bond Review Board (BRB) shows an alarming increase in Texas local debt.”

Citing a $40 billion increase from the year prior, TPPF reports “the total amount owed by cities, counties, school districts, and special districts grew to a combined $499.7 billion in fiscal year (FY) 2024.”

The article further notes:

Yet again, the most heavily indebted governmental type was public school districts. In FY 2024, ISD debt reached $202.6 billion, which represents about 41% of everything borrowed. This latest ISD figure is $17.1 billion higher than the previous year (i.e. $185.5 billion owed in FY 2023). On a per pupil basis, ISDs have accumulated approximately $36,600 of debt for every student currently enrolled.

The article additionally warns the growth trajectory should be “a top concern for policymakers” due to it threatening not only higher tax bills, but also softer economic growth and long-term damage.

Quintero offers these recommendations as “good government reforms that reinforce transparency, trust, and accountability.”

Require bond propositions to include 1-2 simple sentences above the ballot language that describes the measure’s general cost and purpose. The sentences should be written at an 8th grade reading level.

Taxing units, other than school districts, should be required to include the following statement on bond propositions: “THIS IS A PROPERTY TAX INCREASE.” Accentuate the language so that it is obvious to all voters.

Establish a minimum voter turnout requirement as a prerequisite for bond approval.

Require bond elections to be held on the uniform election date in November.

Prohibit ISDs from spending unspent bond proceeds on projects not approved by voters.

He concludes that these reforms “promise a better path forward on public debt” as “it’s well past time to take aggressive action in this space and protect Texas taxpayers from insatiable local governments.”

Another way to look at this is in how Texas compares to other states. The Bond Review Board offers this analysis in its 2024 Annual Report.

Meanwhile we have our national debt. Click here to see the U.S. Debt clock in real time. At $36+ trillion, our nation is hurdling toward a solvency crisis. That’s not a popular position, but reality is a pesky thing and it’s time for serious examination of our across-the-board spending - at all levels of government.

Voting information

It’s important to know that Thursday, April 3, is the last day to register to vote. Click here for voter registration information.

Early Voting by Personal Appearance is scheduled Tuesday, April 22, through Tuesday, April 29. Click here for Early Voting Locations.

Election Day is Saturday, May 3. Click here for Election Day Voting Locations.

A final thought

Responsible money managers don’t just look at one aspect of a financial decision. They analyze all the elements. We, as taxpayers, must do the same. It’s a critical step in protecting our personal fortunes as well as those of our communities – both now and in the future.

Texans for Fiscal Responsibility offered this perspective after last year’s May elections saw mixed bond election outcomes.

The decisions made in these bond elections have long-term financial implications. Approving bonds means committing to decades of debt repayment, which can limit future financial flexibility for both local governments and taxpayers.

It is crucial for voters to understand the implications of bond propositions fully. While bonds can fund important projects, they also increase local debt and property taxes.

Informed voting requires evaluating the necessity and benefits of the proposed projects against the long-term financial impact not only on your own pocketbook, but on the community as a whole.

With Melissa ISD’s projected growth, this is hardly the last bond proposal that voters will see in the upcoming years. Educating voters therefore takes on new importance. This article isn’t advocating a for or against position, but it is promoting smart analysis and knowledge of the election playing field prior to casting your vote.

The mechanics of bond elections also offer an eye-opening educational opportunity. Stay tuned.

Before relocating back to the D/FW Metroplex, Lou Ann Anderson worked in central Texas talk radio as both a host and producer. She currently hosts Political Pursuits: The Podcast. Her tenure as Watchdog Wire–Texas editor involved covering state news and coordinating the site’s citizen journalist network. As a past Policy Analyst with Americans for Prosperity–Texas, Lou Ann wrote and spoke on a variety of public policy issues including the issue of probate abuse.